Value-added-tax rate increases: A comparative study using difference-in- difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

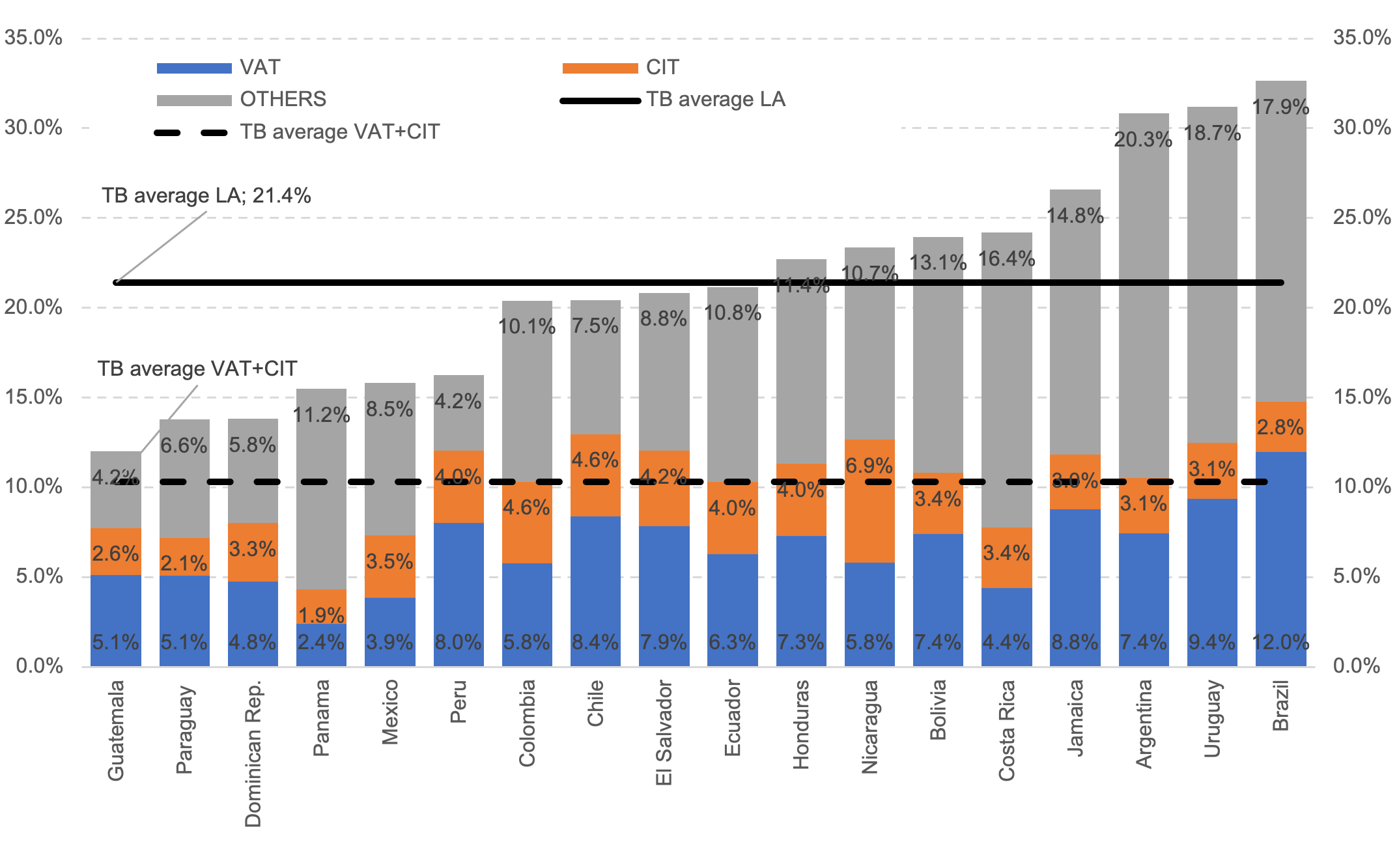

Revenue Efficiency of Value Added Tax and Corporate Income Tax | Inter-American Center of Tax Administrations